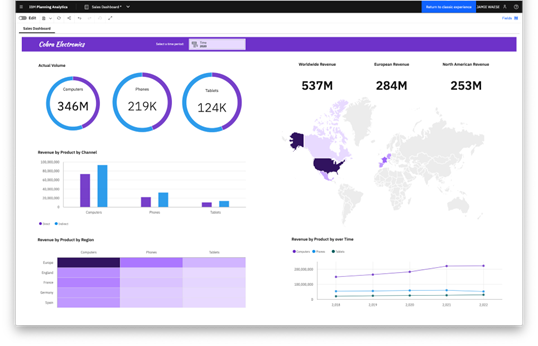

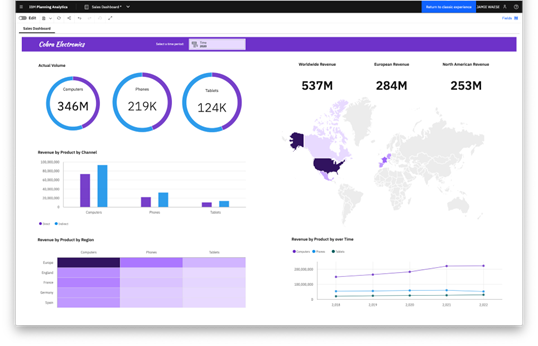

Finance can only truly appreciate data within a single unified data model

A paradox for CFOs is that while companies generate more data than ever before, it’s very hard to get reliable and trustworthy data. Without reliable data, FP&A is difficult, and will become even more so as data volumes keep increasing.

This increase in data makes it difficult for companies to manage and comprehend properly the data they use to run their businesses. The solution is a unified data model.

What is a unified data model?

A unified data model brings together data from different sources and platforms into one place. The data is standardised, so it makes for easy analysis which leads to informed decisions being made based on the data.

An example is IBM’s ‘digital-first’ approach to FP&A.

According to IBM, ‘As we enter a new era of financial transformation with organizations looking to integrate, manage and analyse their enterprise data, the FP&A job description will take on a strategic, digital-first approach.’

This approach involves process automation, agility, transparency which leads to data-driven decisions.

‘FP&A teams are now adopting solutions that allows them to alter plans, reforecast or modify budgets in real time and integrate planning across business units to speed up decision-making, therefore improving the accuracy and reliability of plans and forecasts.’

Becoming a data-centric company

Clearing the path forward to a future-proof, decision-ready state hinges on having one place to ingest, enrich, and transform data, all connected to the system of record; in other words, it requires an intelligent data foundation. A unified, broadly accessible data core is something every successful enterprise must have to succeed if it hopes to modernize finance and the enterprise as a whole.

According to consultancy firm EY, there are certain considerations which organisations need to consider in the planning stage of adopting a unified data model.

These include:

- How will data shape your future business model?

- How deep is your organisation’s appetite for change? Does it favour incremental steps or a redesign from the ground up?

- What is your current tech environment like?

EY think that the right data environment for the future will be an open platform environment which ‘is required to connect and share data, at scale, within and between enterprises and systems. The optimal platform will separate content and technology and be vendor-neutral, distributed and modular — incorporating third-party as well as legacy systems.’

The common information model for FP&A

Similar to a unified data model is the ‘common information model’ (CIM) which is defined by Deloitte as ‘the data elements required to plan, record, report, and measure performance consistently across the enterprise’ and in particular for FP&A.

It covers transactional systems, enterprise resource planning (ERP) and analytical systems, which are broken down further into three layers:

- Core accounting data

- Management information

- Operational data

When designing a CIM, Deloitte have developed six guiding principles.

- Granular details to help make decisions.

- Unique definitions to avoid confusion.

- Flexible design to adapt to future business changes.

- Integrated to support internal and external reporting requirements.

- Consistent across all business entities within organisation.

- Governed properly with clear documentation and training to safeguard data.

Lastly, an intelligent data foundation doesn’t work alone. You need a set of capabilities and technologies to leverage it so you can build (and plan) for the future. These include:

- In-memory architecture. When large amounts of data are stored in memory, processing time is dramatically reduced, and the need to run batch processes to get your final financial reports becomes a thing of the past.

- Real-time data. An increasingly shifting landscape demands real-time data to accurately assess current conditions and constraints and allows for informed decision-making and nimble course corrections.

- Performs complex cost allocations and profitability analysis, letting users drill down for a granular view of profitability by product, customer, region, sales channel and more.

- Provides a unified Web, Excel, experience for all user roles.

- Artificial intelligence (AI) and machine learning (ML). To help you make better decisions faster.

If thinking about rolling out a unified data model, it’s important to partner with a company that has the experience and the understanding of your particular requirements.

For more information contact ProStrategy via email – [email protected]

Be the first to know

Get access to our webinars, whitepapers and case studies. You'll be notified when they are ready to freely view and download:

"*" indicates required fields